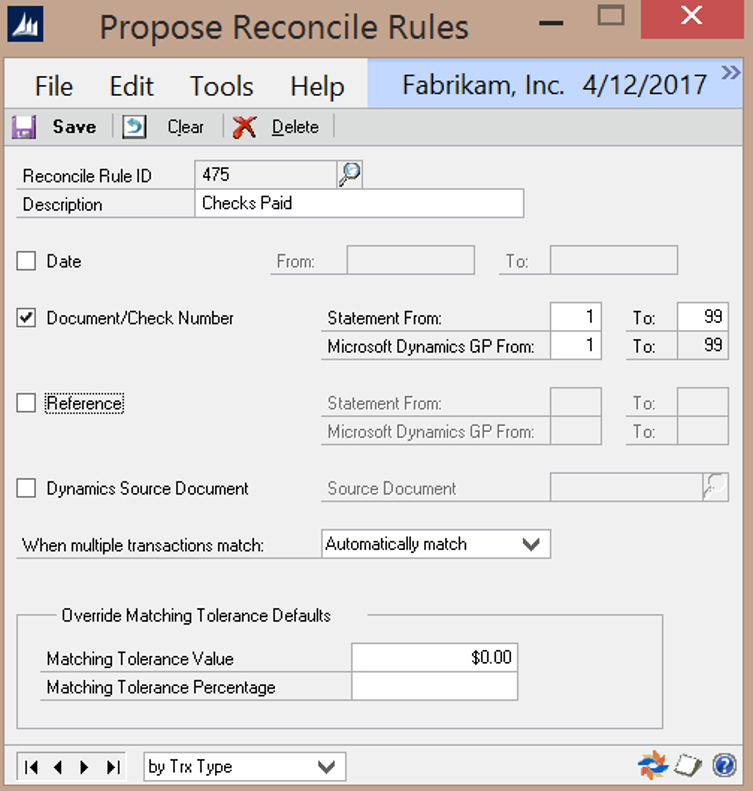

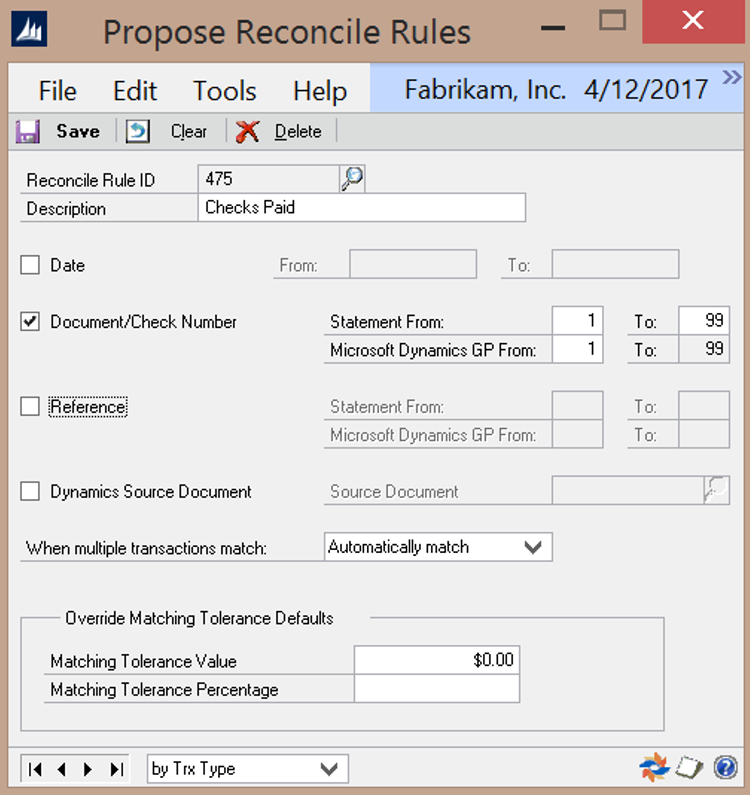

Location

Tools >> Setup >> Financial >> Advanced Bank Reconciliation >> Reconcile Rules

Layout

Overview

Reconcile Rules can assist in automating the reconciliation process. This window is used to assign specific reconcile rules to different Transaction Types. These rules are used to match records when using the Propose process in the Reconcile window.

Note: If a .csv file is being imported from the bank, then the import must contain a Transaction Type field in order to use the reconcile rules or another field that can define the transaction type.

Fields

Transaction Type – A unique name to identify the transaction type that the propose rule applies to. For example, the Transaction Type of “Check” can be defined for check transactions, if that is a valid value in the bank file; or if using BAI statement files the BAI Transaction Type number can be used (see figure above); refer to BAI Transaction Types Import for additional information. The value used here must exist in the bank import file (.csv or BAI). These values are defined by the bank.

Description – A general description for this transaction type.

Date – Checking this box forces the Propose process on the Reconcile window to include dates in the matching process. Define a date range to be used for comparing the dates on bank statement transactions to the dates on GL transactions. For example, if -10 is entered in the From field and 1 in the To field, then a GL transaction with a date between 10 days prior to through 1 day after the bank statement transaction date will be considered a match. Leaving this checkbox unchecked and the From and To fields blank means the dates are not considered in the matching process.

Document/Check Number – Checking this box forces the Propose process on the Reconcile window to include document/check numbers in the matching process. (see example below) Define, if necessary, the character range to be used when comparing the check number on the bank transaction to the check number on the GL transaction. (From/To fields can be left blank to match the entire check number from the bank statement transaction to the entire check number from GP). Leaving this checkbox unchecked and the From and To fields blank means the Document/Check Numbers are not considered in the matching process.

Reference – Checking this box forces the Propose process on the Reconcile window to include reference in the matching process. Define the character range used when comparing the reference field on the bank statement transaction to the GL transaction reference. Leaving this checkbox unchecked and the From and To fields blank means the references are not considered in the matching process. Use the From and To fields to only extract partial values.

Dynamics Source Document – Check this option to choose the source document of the GL transaction that matches to this transaction type. Leaving this checkbox unchecked means the Dynamics Source Documents are not considered in the matching process.

Override Matching Tolerance Default – Check this option to have tolerance values set for specific Transaction

Types.

Buttons

Save – Save the current Reconcile Propose Rules

Clear – Clear all fields

Delete – Delete the current Reconcile Propose Rules

Reconcile Rules Example

A company wants to further define the propose rules for AP Checks by matching the Check Number from GP to the

Check Number from the bank statement transaction.

For this example, a reconcile rule will be defined in the Reconcile Rules window (Tools >> Setup >> Financial >> Advanced Bank Reconciliation >> Reconcile Rules) for the Transaction Type of “475”, which is the BAI Code, contained in the bank file, for Checks Paid.

To have the transactions matched by the check number, select the Document/Check Number option and indicate the characters of the document number fields that should be compared. For this example, characters 1 through 6 from the Bank Statement Transaction are being matched to characters 2 through 7 from Dynamics GP. This would accommodate for a leading zero on the GP check number that is not being imported on the Bank Statement Import file. (GP Check Number = 0123456, Bank Statement Check Number = 123456)